- 联系我们

- 电话: 400-629-1995 / 13911395074

- 邮箱: info@guoyifanyi.com

- English

- Français

笔译:彭博数据解读:中国国企改革

本文原载于Bloomberg

编译/雨山 & eve

译读:T-Read | 译读小号二世:WinnieTheFool

距习立誓国企改革已经过去三年,国企目前却每况愈下。不仅钢铁等传统的“大烟囱”行业如此,消费和医疗行业也开始萎靡。

为了判断中国国企改革的进度,彭博选择了346家国有企业,追踪统计了从2012年(习于2013年3月上任)到去年,各企业股本回报率,资产收益率,利息保障倍数,财务杠杆和应收账款周转天数的变化。

如下文五个表格所示,不仅煤矿业和钢铁制造业存在问题,必需消费品和医疗保健行业也存在经营僵化的情况。除了类似中国广核集团的公用事业单位,国企涉及的经济分支几乎都存在严重问题,不是负债率过高就是投资回报率偏低。即便是科技公司,盈利率和资产收益率也都不高。

未经改革的国企无论曾经怎样希望满满,如今都早已令人大失所望。尽管政府仍坚持对僵化国企进行大整改,但其在维系经济运行上取得的成绩又减少了整改的动力。物价在回升,房地产市场开始复苏,上证A股较一月低谷期上升了11%。然而,这并不是好消息,因为习一直大肆吹嘘改革能动摇中国肚满肠肥的企业集团的根基,这些消息会成为其自满的理由。

高杠杆和低效率已经不仅限于必需消费品行业和造船业。另外,由于负债支撑的增长模式或将卷土重来,政府是否真心要收拾烂摊子,尚需若干年方有定论。

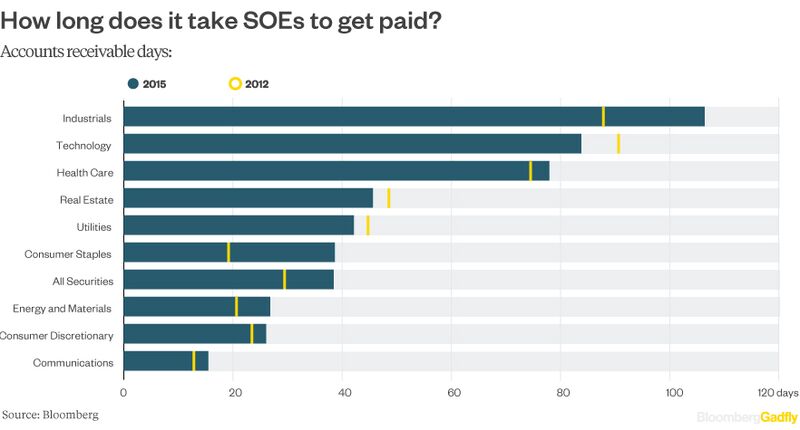

国企资金回收速度

应收账款周转天数

从上至下依次为:

工业、科技、医疗卫生保健、房地产、公用事业、必需消费品、证券、能源与材料、非必需消费品、通讯

数据来自:彭博社

机车制造业和造船业等部门的工业企业,如今的应收账款周转日期平均都达到了106天。难怪这些国企成为政府改革的切入口。改革虽已取得一些进展,但还没有收到足够的成效。去年12月,中国远洋运输集团与中国海运集团兼并,希望借此能够增加在产能过剩、贸易减缓的造船业中的谈判筹码。去年6月,中国北车集团与中国南车集团合并成立中国中车,以在机车车辆装备制造领域对抗来自德国西门子等企业的竞争。

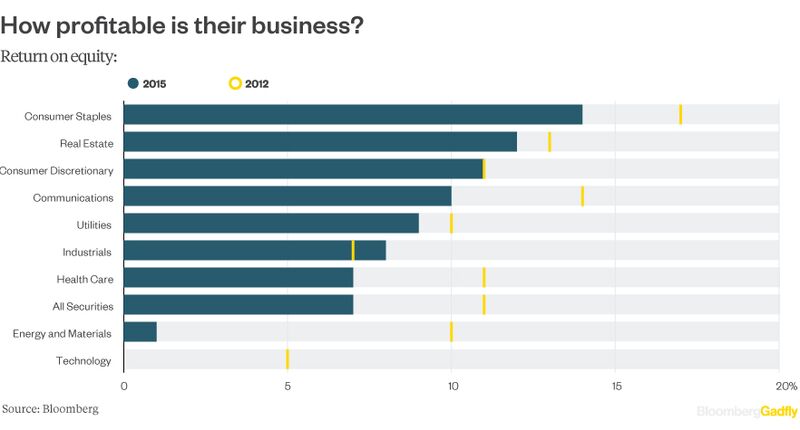

国有企业盈利水平

股本回报率

从上至下依次为:

必需消费品、房地产、非必需消费品、通讯、公用事业、工业、医疗卫生保健、证券、能源与材料、科技

数据来自:彭博社

贵州茅台等必需消费品企业尽管很受投资者青睐,但他们的盈利能力在过去三年也受到了通货紧缩上行压力的打击。对这些企业来说,私有化或将是更好的选择,并入像阿里巴巴这样的国际企业或众多中国创业公司。这些公司科技水平高,且更加敏捷灵巧,更易于落实新的想法,迎合快速变化的新潮流。

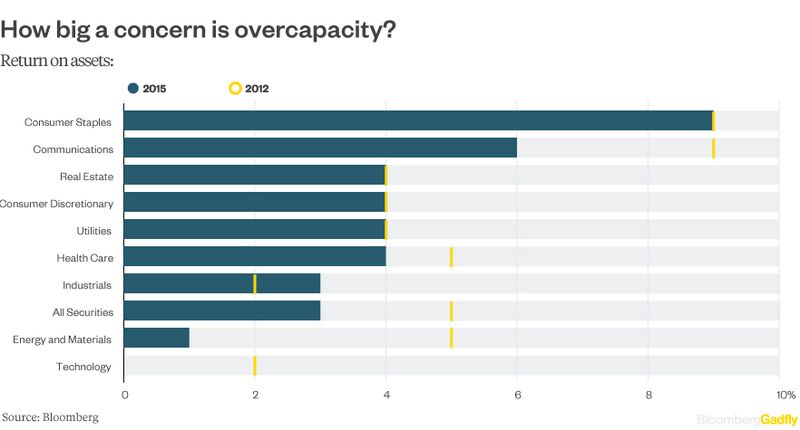

产能过剩水平

资产收益率

从上至下依次为:

必需消费品、通讯、房地产、非必需消费品、公用事业、医疗卫生保健、工业、证券、能源与材料、科技

数据来自:彭博社

多数行业部门资产收益率均呈下落趋势,可见国家经济整体面临严重的产能过剩。今年1月,国务院宣布计划减少1亿到1.5亿吨钢铁产能,但未提及具体时间表。美国经济预测机构环球透视(IHS Global Insight)估计,中国钢铁企业2015年由于价格暴跌,损失约120亿美元。国务院称,煤炭行业的产能也会“相对大幅”削减。

去杠杆化是否已经开始?

总资产/资产净值

从上至下依次为:

房地产、非必需消费品、工业、证券、公用事业、能源与材料、科技、医疗卫生保健、通讯、必需消费品

数据来自:彭博社

上月接受彭博社总编辑约翰·米可斯维特采访时,摩根大通集团首席执行官杰米·戴蒙表示,中国也许认为健康的股市有助于减少企业的债务负担,所以想在一些国有企业通过股权融资去杠杆。此举原因很明显,中国的企业,尤其是庞大笨重的房地产开发商,都在靠很少的资产净值支撑巨大的资产总额。不难想象,股权融资之后,为了不让贷款方对国企的财务状况失去信心,中国自然会放任股价虚高。然而中国需要的,是真正的去杠杆。

债务清偿难度

利息/息税前利润

从上至下依次为:

能源与材料、科技、工业、公用事业、证券、非必需消费品、医疗卫生保健、房地产、必需消费品、通讯

数据来自:彭博社

考虑到钢铁行业产量严重过剩,需要向全世界兜售,或许也就不难理解为什么国有煤炭钢铁企业及其他能源与材料企业的偿债负担最重了。数据显示,在能源与材料行业,缴付利息与息税前利润的比例在去年激增到34%,超过其他国有行业。分析人士也曾质疑政府去产能的努力。惠誉评级称, 2015年被叫停的厂家产能共计6000万吨,其中只有1700万吨,即不到三分之一被永久关停。

当然,这并不是说政府无意也无力彻底改革国企。《东亚研究期刊》2009年的一篇文章提到,上世纪90年代初,政府致力建立“社会主义市场经济”时,国企总数为11.3万家,1998年减少到6.5万, 2005年前后减少到2.7万。据摩根斯坦利的分析人士估算,国企数目现在已经减少到2万,其中110家为中央企业。

每一步改变都令人担忧,并可能引发当局希望竭力避免的社会动荡。无论在哪个国家,既要避免经济增速继续下落,又要摆脱投资驱动型的发展模式,这种事情从来都需要谨慎稳妥权衡利弊。目前,中央应尽快实现这个平衡,因为数据显示,他们的时间已所剩不多。

Three years after President Xi Jinping vowed to shake up state-owned enterprises, they're looking worse than ever. And not just in traditional smokestack industries such as coal and steel -- the malaise has spread to consumer and health-care firms.

Gadfly examined 346 state-owned companies to gauge the progress of China's SOE reform, tracking the change in return on equity, return on assets, interest cover, financial leverage and accounts-receivable days between 2012, before Xi took office in March 2013, and last year.

As the resulting five charts show, the problems go deeper than those faced by coal miners and steelmakers. Zombie-like characteristics also exist in consumer-staples companies and health-care firms. Outside of utilities like China General Nuclear Power, practically every part of China's economy touched by state ownership has serious issues, either in terms of the amount of debt companies owe or investor returns. Even tech outfits score low on profitability and return on assets.

Whatever promise China's unreformed SOEs may have once held has long turned to disappointment. While the government continues to insist on an overhaul of its sclerotic state firms, its efforts to prop up the economy are bearing fruit -- reducing the pressure for change. Commodity prices are rebounding, there are green shoots in the property market, and the Shanghai A-share stock index is up 11 percent from its January low. All that, paradoxically, is bad news, because it lends an air of complacency to Xi's much-vaunted push to shake up China's bloated conglomerates.

Huge amounts of leverage and inefficiency aren't the bailiwick of commodities players and shipbuilders any longer. And with debt-fueled growth showing signs of making a comeback, it may be years before Beijing's resolve to clean up the mess is tested.

Industrial companies, including trainmakers and shipbuilders, now wait an average of 106 days to get paid. Little wonder these SOEs rank among the highest on China's reform to-do list. Some progress has been made but changes haven't gone far enough. In December, China Ocean Shipping Group was merged with China Shipping Group in the hope that combined, they could improve their collective bargaining power in a shipping industry plagued by overcapacity and slowing trade. Last June, China CNR Corp. teamed with CSR Corp. to create CRRC Corp., a train equipment maker to challenge the likes of Germany's Siemens.

While consumer-staples firms including liquor maker Kweichou Moutai are favored by investors, the sector's profitability has taken a hit over the past three years as deflationary pressures mount. Perhaps some of these businesses would be better in private hands, run by, for example, the Alibabas of the world, or one of the country's many startups. These more nimble, tech-savvy companies are better placed to execute on ideas quickly and embrace rapidly changing trends.

Return on assets has fallen in most industries, illustrating the rampant glut China faces economy-wide. The State Council said in January it plans to cut steel production capacity by 100 million to 150 million tons, without specifying a time frame. Facing a slump in prices, China's steel producers lost an estimated $12 billion in 2015, according to IHS Global Insight. Coal production capacity will also be reduced on a ``a relatively large scale,'' the State Council said.

上一篇:中德“特殊关系”:和平合作的典范

下一篇:特朗普上任,中美贸易战是否一触即发? | 译周世界

在办理留学、移民、签证、国际商务、海外结婚、房产交易等涉及俄罗斯的业务时,相关机构通常要求提供俄语版的户口本翻译件。由于户口本是重

失量vector电热矿化electrothermal mineralization氟化钙calcium fluoride石英砂quartz sand思政育人ideological and political educ

培训师傅明艳(L)和姜波雅装备导盲犬在中国东北辽宁省大连市进行训练,时间为2021年4月23日。中国导盲犬训练中心的大连分公司成立于2006年